Presidential ordinance: NAB, Nadra get access to tax data; 35% additional income tax on electricity bills of non-filers

Under the new Presidential Ordinance NAB, Nadra get access to tax data and 35% additional income tax imposed on electricity bills of non-filers.

President Dr. Arif Alvi has promulgated a new ordinance for the broadening of the tax base.

Under the Tax Laws (Third Amendment) Ordinance 2021, the government has granted sweeping powers to the Federal Board of Revenue (FBR) for the disconnection of mobile phones/SIMs, electricity, and gas connection of non-filers.

The ordinance empowers the anti-corruption watchdog to reopen two-decade-old transactions.

Moreover, it has also been given access to offshore tax data the Organisation for Economic Cooperation and Development (OECD) shares with Pakistan.

As per the new ordinance, the non-filers could also be deprived of banking facilities.

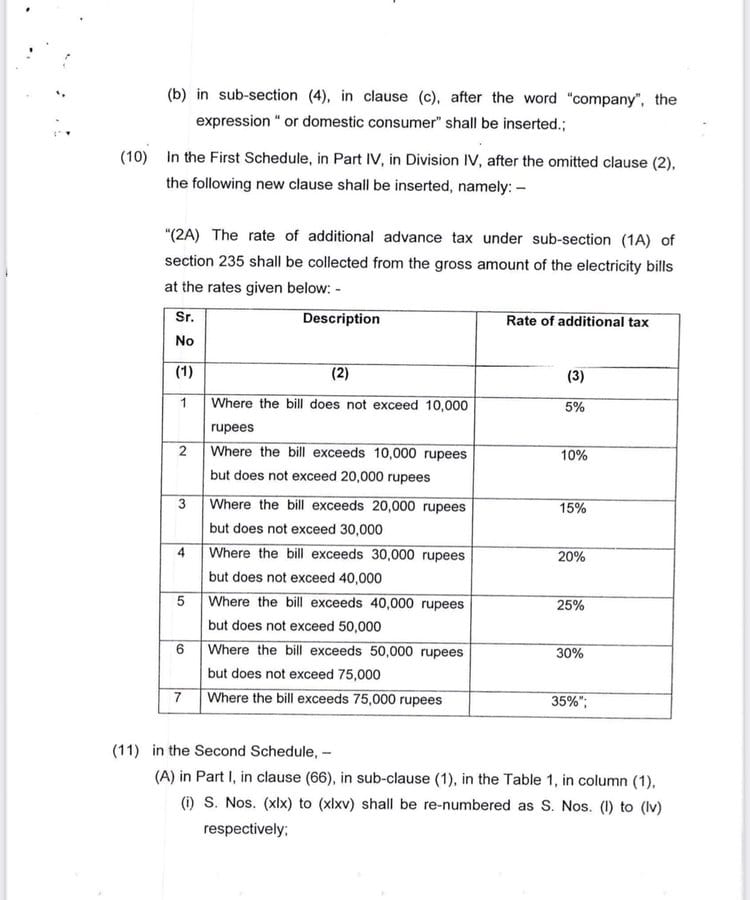

While a 35% additional income tax has been imposed on domestic electricity bills of non-filer professionals.

The new law stipulates a punishment of one-year imprisonment and an Rs0.5 million fine for persons who provide wrong information to evade tax.

The government has also given powers to the FBR to discontinue gas and electricity connections of persons, including tier-1 retailers who are either not registered or if registered, are not integrated in terms of Section 3(9A) of the Sales Tax Act 1990.