FBR to reduce duties on import of mobile phones up to 50%

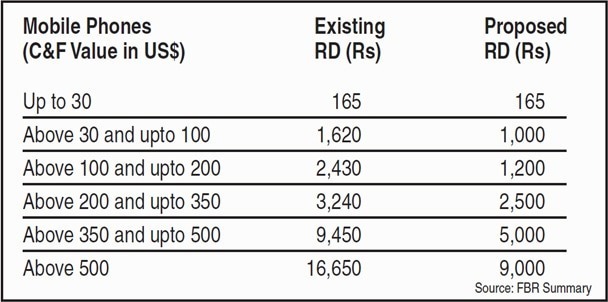

The Federal Board of Revenue (FBR) has proposed to reduce regulatory duty (RD) on import of mobile phones by up to 50 percent in some cases, saying the move is aimed to “provide relief to the common man and to support digitization endeavours.”

The sharpest reduction in RD will be on mobile handsets with a cost and freight value between $100 and $200, where the existing RD rate is Rs2,430 that the FBR is proposing to bring down to Rs1,200.

However, this move is expected to have no impact on the overall collection of duties under this head, since the FBR believes it will lead to a higher volume of imports.

Reportedly, a summary has been forwarded to the ministry of Finance in this regard. It says that the move is aimed at providing relief to the common man.

Read More : Tax rate for token payments, registration of cars not changed: FBR

The summary, which carries the signature of FBR Chairman Shabbar Zaidi, says, “This reduction in duty/tax is expected to increase import volume of mobiles in Pakistan”. This may “to some extent, neutralize the otherwise negative impact of this measure.”

The duties and taxes on mobile phones were reduced in the last budget announced in May.

Furthermore, the same summary has also proposed to eliminate the regulatory duty imposed on “worn clothing and other worn articles”, stressing that “these clothing articles are used by low-income people”. At the moment, worn clothing and articles are subject to 10pc RD.